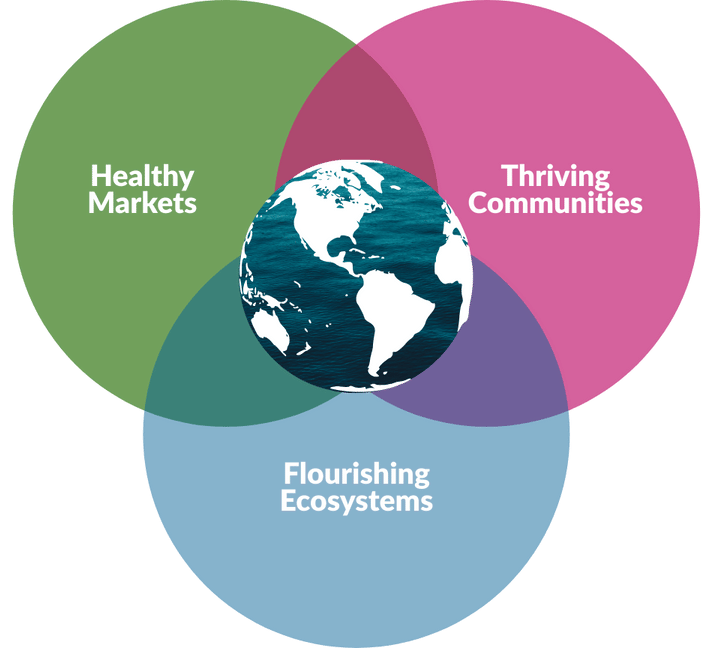

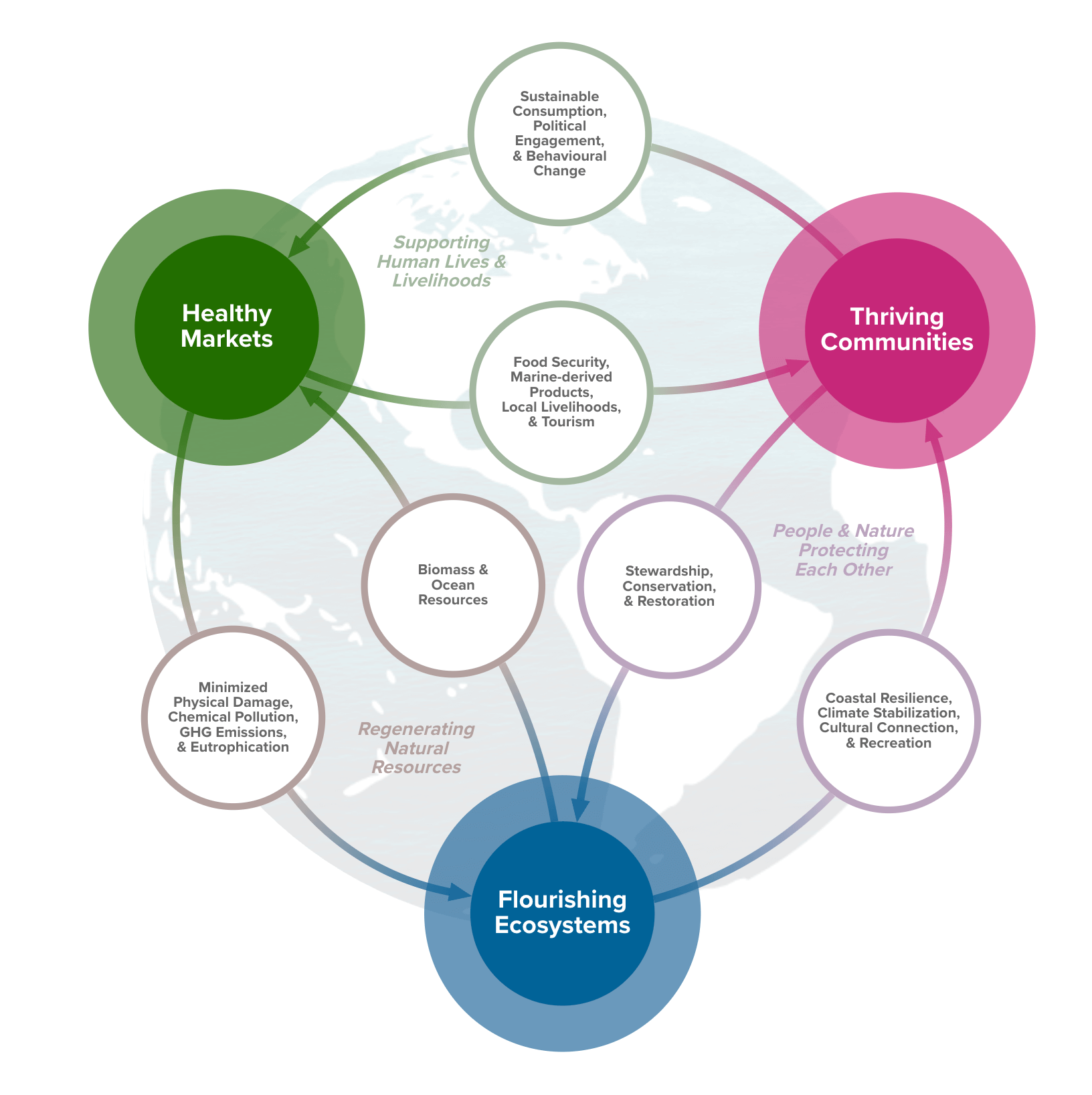

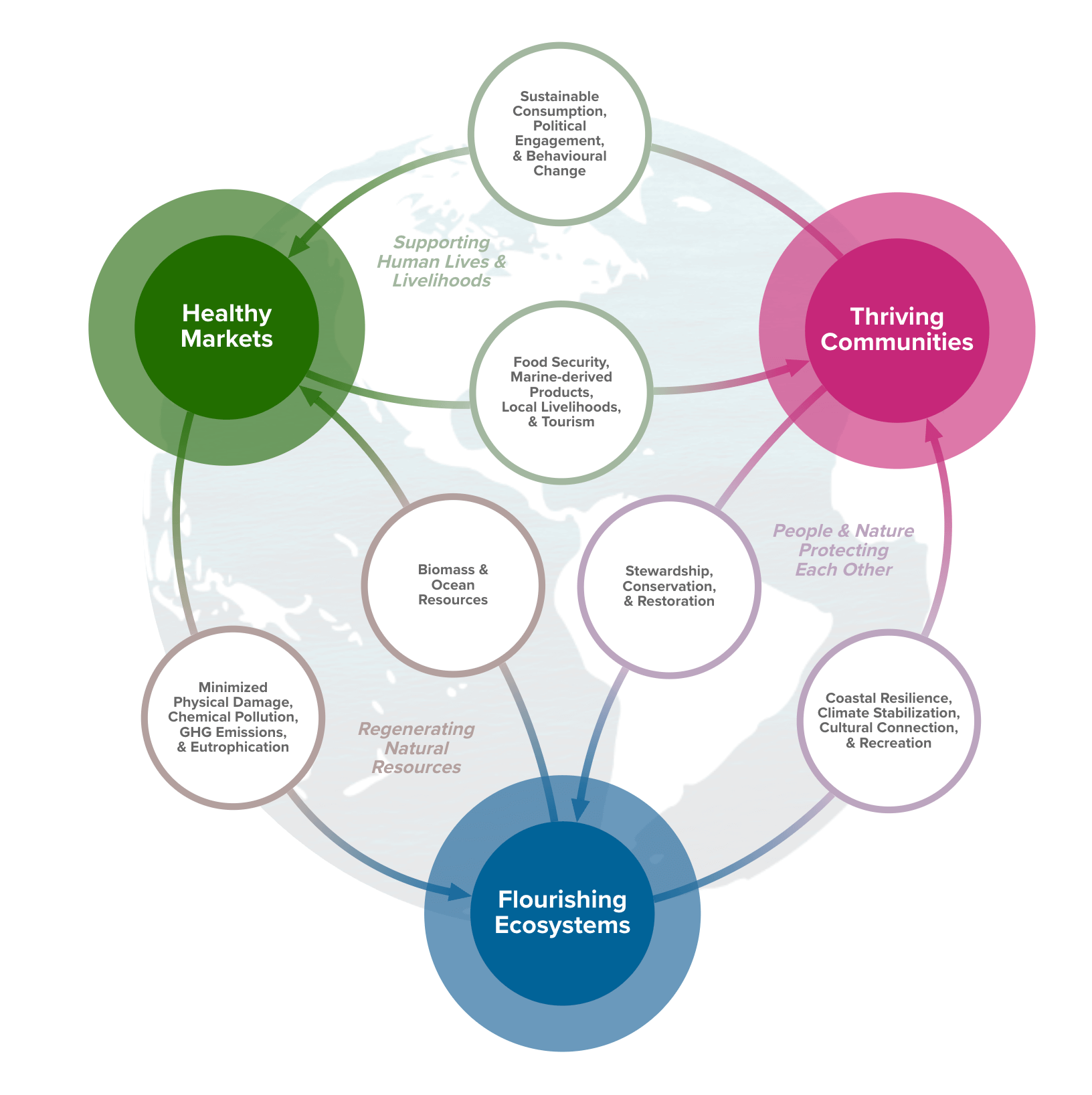

Explore the interrelation between healthy markets, thriving communities and flourishing ecosystems.

Explore the interrelation between healthy markets, thriving communities and flourishing ecosystems.

The Ocean: A Vital Resource Under Threat

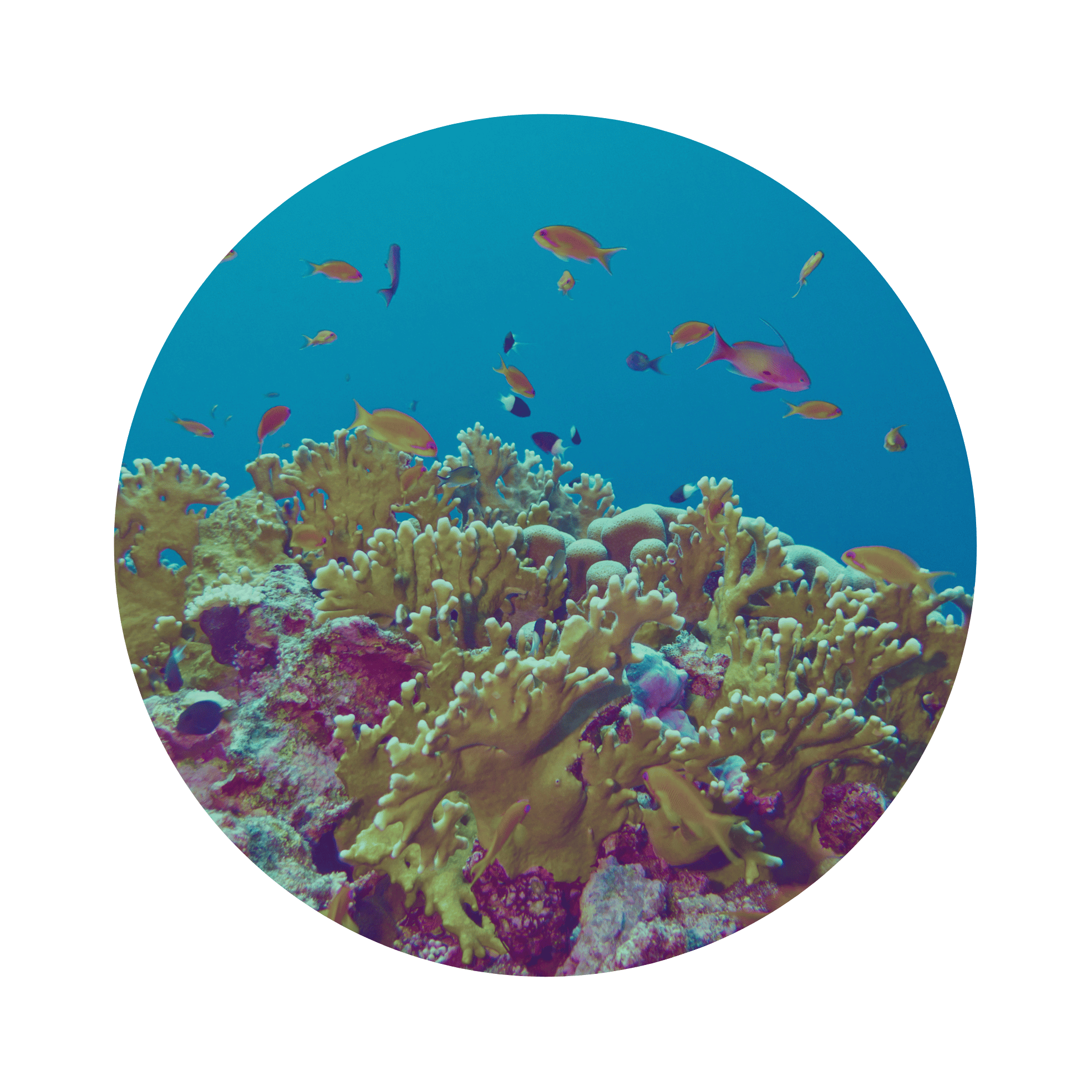

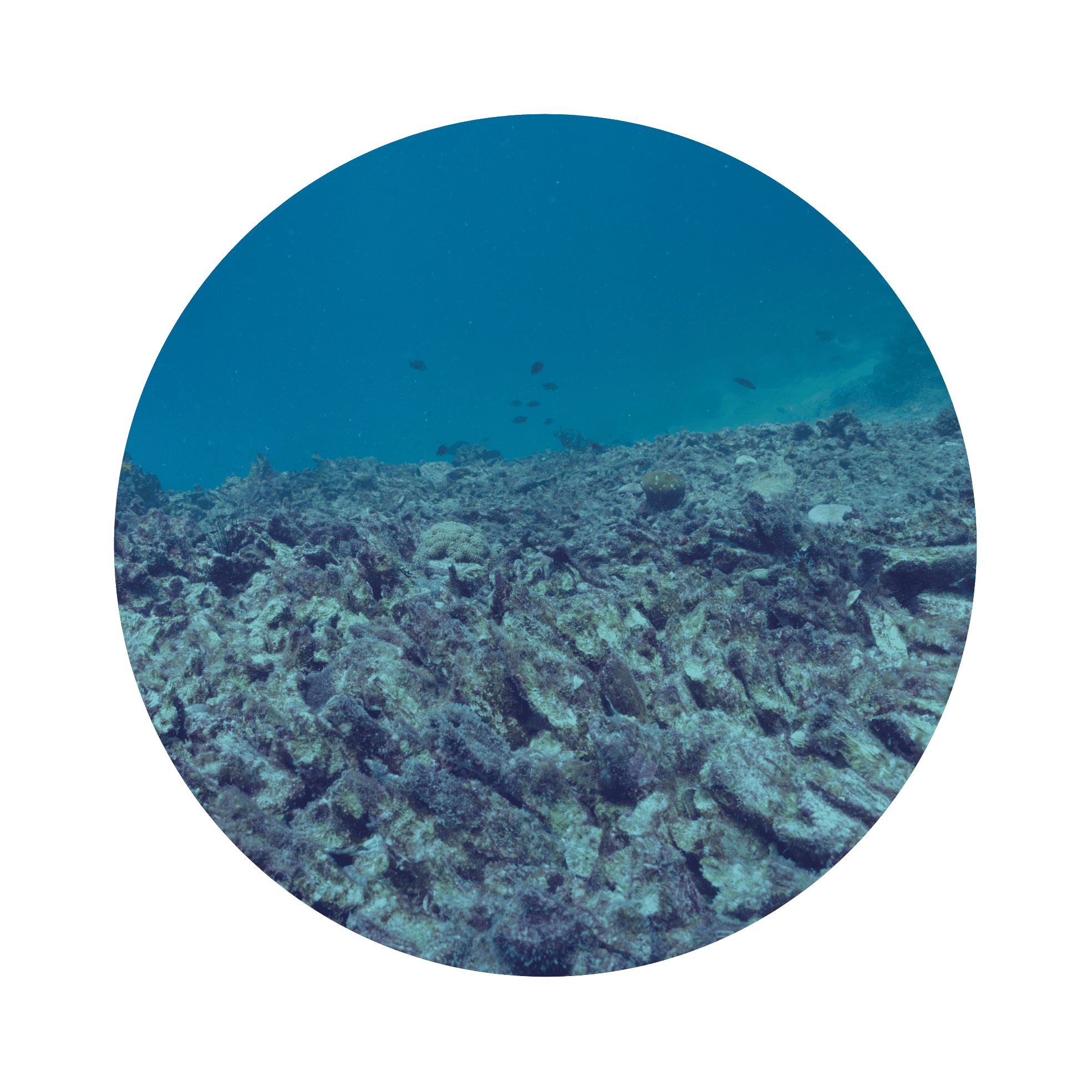

The ocean, the planet’s greatest natural asset, is increasingly threatened by human activities. The climate crisis, biodiversity loss, and pollution jeopardize not only the ocean’s role in sustaining crucial planetary processes but also its status as an economic powerhouse.

Current Solutions Are Inadequate

Efforts to address ocean health are fragmented and too slow. Investment in ocean solutions aims to improve ocean health and drive a shift toward a sustainable ocean economy. However, the scale and speed of current initiatives fall short of the urgent transformation needed in ocean-linked sectors.

The Ocean: A Vital Resource Under Threat

The ocean, the planet’s greatest natural asset, is increasingly threatened by human activities. The climate crisis, biodiversity loss, and pollution jeopardize not only the ocean’s role in sustaining crucial planetary processes but also its status as an economic powerhouse.

Current Solutions Are Inadequate

Efforts to address ocean health are fragmented and too slow. Investment in ocean solutions aims to improve ocean health and drive a shift toward a sustainable ocean economy. However, the scale and speed of current initiatives fall short of the urgent transformation needed in ocean-linked sectors.

A New Paradigm Is Essential

One reason for this is that the issues we and the ocean face are systemic. The planet is an interconnected whole with flora, fauna, ocean currents, local and global climate systems all affecting each other and working together.

To address these complex and systemic challenges at the necessary pace, it’s crucial to shift from supporting single-point solutions to a holistic strategy. This approach must focus on identifying and investing in ocean systems levers to catalyze structural change. The planetary triple crisis is larger than any single intervention; it’s time to focus on systemic investment and embrace strategic collaboration.

The entire range of living matter on Earth from whales to viruses and from oaks to algae could be regarded as constituting a single living entity capable of maintaining the Earth's atmosphere to suit its overall needs and endowed with faculties and powers far beyond those of its constituent parts.

- JAMES LOVELOCK

What is Systemic Investing?

Systemic investing is the deployment of capital through multi-capital strategies to address complex, interconnected problems at scale. It involves working with multiple stakeholders to create coordinated actions that target leverage points within systems to drive positive, holistic impact.

Unlike traditional approaches, which may focus on isolated interventions or short-term returns, systemic investing seeks to make a lasting impact by tackling the root causes of systemic challenges. By aligning financial resources, social influence, and other forms of capital, systemic investing supports solutions that address the broader systems in which they operate.

What is Systemic Investing?

Systemic investing is the deployment of capital through multi-capital strategies to address complex, interconnected problems at scale. It involves working with multiple stakeholders to create coordinated actions that target leverage points within systems to drive positive, holistic impact.

Unlike traditional approaches, which may focus on isolated interventions or short-term returns, systemic investing seeks to make a lasting impact by tackling the root causes of systemic challenges. By aligning financial resources, social influence, and other forms of capital, systemic investing supports solutions that address the broader systems in which they operate.

Systemic investing assumes that systems change is most likely the effect of multiple shifts happening within a system at the same time and with a degree of strategic coherence, which means that the challenge is to develop a funding architecture capable of directing different forms of capital to enable a multitude of intervention under a transformative theory of change.

- DOMINIC HOFSTETTER

Systemic Ocean Investment

The shifts required within a system to trigger transformative effects have varied funding needs and require different forms of intervention. Some areas may allow market-rate for-profit investment, while others may need non-repayable grants, government subsidies, or tax incentives. These funding needs span the risk-return and impact spectrum.

A multi-capital strategy enables individuals and organizations to leverage their full suite of resources—financial investments, networks, influence, and expertise—for greater impact. An orchestrated funding architecture will allow deploying a systemic funding strategy, that supports the better achievement of an organisation’s mandate, alongside helping to create the large scale impact that an organisation is not capable of doing on its own. We need diverse actors to strategically align and coordinate their efforts to create a systemic funding architecture for the ocean.

Katapult Ocean and Builders Vision are leading the charge to catalyze this new reality for the broader ocean community. Together, we are co-creating a holistic Systemic Ocean Investment approach and strategy to catalyze positive regrowth in ocean health.

What are we developing to support this paradigm shift?

We are using System Dynamics Modelling methodologies to map key ocean systems and develop a strategy to influence them in the right direction. Here we showcase a teaser of a larger ocean systems change mapping and strategy suite for the finance community to catalyze holistic regrowth of ocean health.

The Systems

1. Ocean and Economy Systems

To understand the interdependencies and linkages within the ocean system, we are mapping ocean ecosystems, sector impacts on the ocean, and the drivers behind these systems. This will help build portfolios that work “hand-in-hand” to reinforce systemic change and impact, rather than scaling isolated solutions.

Such a map will highlight clusters of enabling, scalable, and investable solutions for restoring ocean health. It will guide stakeholders in building a holistic ocean investment strategy, considering the relationships and dependencies between the ocean system, society, and economic sectors. This approach will be useful for both those developing deep investment theses based on science and those just entering the space.

2. The Ocean Capital System

An in-depth mapping of all ocean finance stakeholders will reveal gaps in current solution coverage and capital flows. This mapping will identify where future capital flows and network development could be most valuable from an investment perspective, while also highlighting potential collaborations for greater impact.

Credits: Hibah Khan, Research Assistant, MIT Sloan Sustainability Initiative; Dr. Jason Jay, Director MIT Sloan Sustainability Initiative; Alban Yau, Research Affiliate, MIT Sloan Sustainability Initiative; Brian Blankinship, The Structure Agency

Credits: Hibah Khan, Research Assistant, MIT Sloan Sustainability Initiative; Dr. Jason Jay, Director MIT Sloan Sustainability Initiative; Alban Yau, Research Affiliate, MIT Sloan Sustainability Initiative; Brian Blankinship, The Structure Agency

The Strategy

Systemic Ocean Investment

Based on these system maps, we aim to develop an open-access Systemic Ocean Investment Strategy that highlights key leverage points within the ocean space. This strategy will support investors and other ocean stakeholders by helping them understand their position and influence within the broader ocean system. By leveraging their roles and priorities through a multi-capital lens, they will be guided to maximize their impact.

This strategy will also identify previously overlooked interdependencies, enabling stakeholders to contribute to filling existing gaps, such as in the creation and facilitation of investment-relevant ocean data.

Key Strategic Insights

Systemic Approach: Investing in several solutions that, combined, have a systemic impact rather than simply scaling single-point solutions. Portfolio strategies must be developed to work hand-in-hand, reinforcing each other’s impacts.

Bioregional and Temporal Dimensions: To ensure urgency and relevance, the strategy will consider bioregional and temporal factors—guiding stakeholders to focus on the most urgent issues and their specific geographies.

Multicapital Approaches: Beyond capital investment and acceleration, the strategy will highlight opportunities for using influence, networks, and expertise to leverage additional impact. Stakeholders will be encouraged to identify where the gaps are in terms of capital, expertise, and collaboration to maximize leverage.

Ultimately, the Systemic Ocean Investment Strategy will include specific recommendations for actions and targets for each stakeholder group—from VC investors and high-net-worth individuals (HNWIs) to institutional investors and other ocean finance stakeholders—to catalyze a holistic transformation of the ocean system.

The Strategy

Systemic Ocean Investment

Based on these system maps, we aim to develop an open-access Systemic Ocean Investment Strategy that highlights key leverage points within the ocean space. This strategy will support investors and other ocean stakeholders by helping them understand their position and influence within the broader ocean system. By leveraging their roles and priorities through a multi-capital lens, they will be guided to maximize their impact.

This strategy will also identify previously overlooked interdependencies, enabling stakeholders to contribute to filling existing gaps, such as in the creation and facilitation of investment-relevant ocean data.

Key Strategic Insights

Systemic Approach: Investing in several solutions that, combined, have a systemic impact rather than simply scaling single-point solutions. Portfolio strategies must be developed to work hand-in-hand, reinforcing each other’s impacts.

Bioregional and Temporal Dimensions: To ensure urgency and relevance, the strategy will consider bioregional and temporal factors—guiding stakeholders to focus on the most urgent issues and their specific geographies.

Multi-capital Approaches: Beyond capital investment and acceleration, the strategy will highlight opportunities for using influence, networks, and expertise to leverage additional impact. Stakeholders will be encouraged to identify where the gaps are in terms of capital, expertise, and collaboration to maximize leverage.

Ultimately, the Systemic Ocean Investment Strategy will include specific recommendations for actions and targets for each stakeholder group—from VC investors and high-net-worth individuals (HNWIs) to institutional investors and other ocean finance stakeholders—to catalyze a holistic transformation of the ocean system.

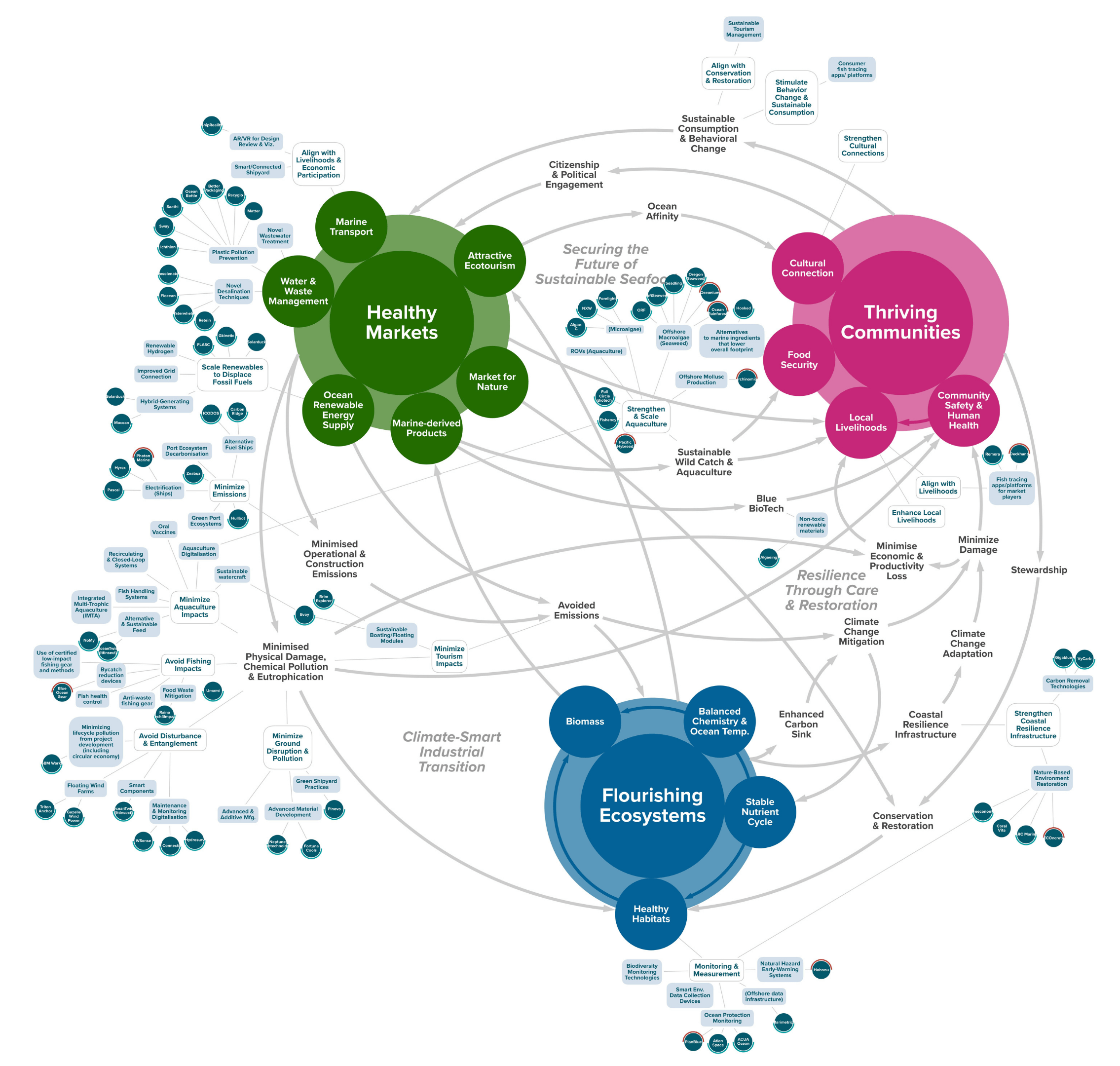

The Systems Map

About the Map

A true systems approach requires more than breaking down the problem. The map positions these three subsystem indicators as interlocking, where health in one area depends on health in the other.

The interdependencies are illustrated by the arcs between them and described by their cause-and-effect relationships.

For example, Food Security (Communities) depends upon a sustainable and accessible Market for Marine-Derived Products (Markets) which, in turn, depends on sufficient Biomass (Ecosystems) that enable extraction without destabilising the broader ocean ecosystem.

The map depicts a narrative of a healthy, self-sustaining future system, one that is currently endangered by human activity. Realising this future requires intervention, in the form of sustainability transitions in our industrial and market systems, accompanied by the smart scaling of markets for restoration, and enabled by behaviour change and citizenship in support of a healthy ocean.

Credits: Hibah Khan, Research Assistant, MIT Sloan Sustainability Initiative; Dr. Jason Jay, Director MIT Sloan Sustainability Initiative; Alban Yau, Research Affiliate, MIT Sloan Sustainability Initiative; Brian Blankinship, The Structure Agency

Credits: Hibah Khan, Research Assistant, MIT Sloan Sustainability Initiative; Dr. Jason Jay, Director MIT Sloan Sustainability Initiative; Alban Yau, Research Affiliate, MIT Sloan Sustainability Initiative; Brian Blankinship, The Structure Agency

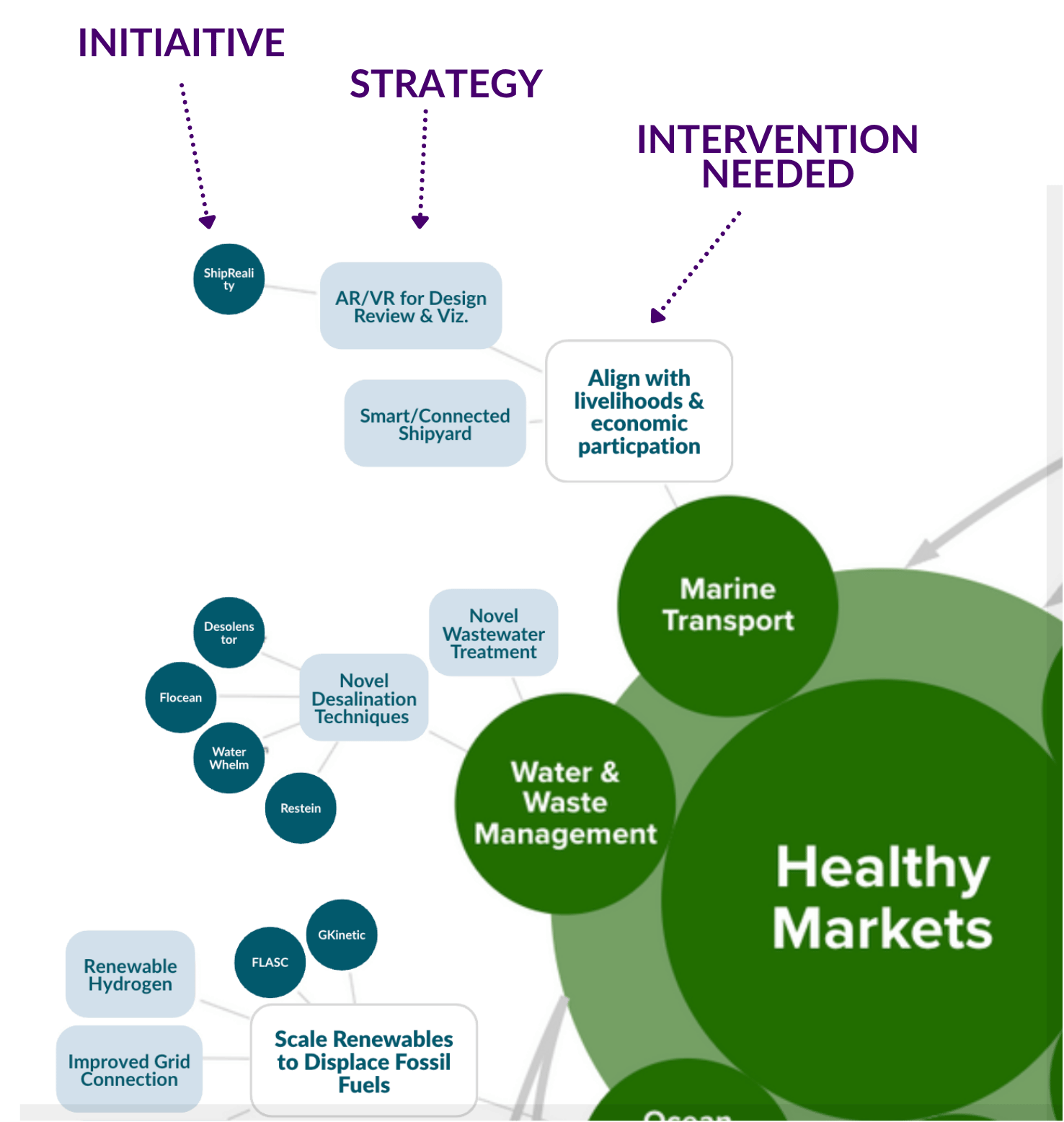

Explore the Map

Credits: Hibah Khan, Research Assistant, MIT Sloan Sustainability Initiative; Dr. Jason Jay, Director MIT Sloan Sustainability Initiative; Alban Yau, Research Affiliate, MIT Sloan Sustainability Initiative; Brian Blankinship, The Structure Agency

Map Features

Interventions

The Interventions are drawn from global taxonomies. Select the options in the bottom menu to showcase interventions by sector.

Initiatives

These interventions are applied by real-world, market and non-market initiatives, including investable companies and projects.

Click the initiative circles to reveal links to their website and a brief description.

Initiatives are drawn from the portfolios of our partner investors.

Tour

Credits: Hibah Khan, Research Assistant, MIT Sloan Sustainability Initiative; Dr. Jason Jay, Director MIT Sloan Sustainability Initiative; Alban Yau, Research Affiliate, MIT Sloan Sustainability Initiative; Brian Blankinship, The Structure Agency

Credits: Hibah Khan, Research Assistant, MIT Sloan Sustainability Initiative; Dr. Jason Jay, Director MIT Sloan Sustainability Initiative; Alban Yau, Research Affiliate, MIT Sloan Sustainability Initiative; Brian Blankinship, The Structure Agency

What are we developing to support this paradigm shift?

We are using System Dynamics Modelling methodologies to map key ocean systems and develop a strategy to influence them in the right direction. Here we showcase a teaser of a larger ocean systems change mapping and strategy suite for the finance community to catalyze holistic regrowth of ocean health.

The Systems

1. Ocean and Economy Systems

To understand the interdependencies and linkages within the ocean system, we are mapping ocean ecosystems, sector impacts on the ocean, and the drivers behind these systems. This will help build portfolios that work “hand-in-hand” to reinforce systemic change and impact, rather than scaling isolated solutions.

Such a map will highlight clusters of enabling, scalable, and investable solutions for restoring ocean health. It will guide stakeholders in building a holistic ocean investment strategy, considering the relationships and dependencies between the ocean system, society, and economic sectors. This approach will be useful for both those developing deep investment theses based on science and those just entering the space.

2. The Ocean Capital System

An in-depth mapping of all ocean finance stakeholders will reveal gaps in current solution coverage and capital flows. This mapping will identify where future capital flows and network development could be most valuable from an investment perspective, while also highlighting potential collaborations for greater impact.

Systems Map

Credits: Hibah Khan, Research Assistant, MIT Sloan Sustainability Initiative; Dr. Jason Jay, Director MIT Sloan Sustainability Initiative; Alban Yau, Research Affiliate, MIT Sloan Sustainability Initiative; Brian Blankinship, The Structure Agency

Credits: Hibah Khan, Research Assistant, MIT Sloan Sustainability Initiative; Dr. Jason Jay, Director MIT Sloan Sustainability Initiative; Alban Yau, Research Affiliate, MIT Sloan Sustainability Initiative; Brian Blankinship, The Structure Agency

About the Map

A true systems approach requires more than breaking down the problem. The map positions these three subsystem indicators as interlocking, where health in one area depends on health in the other.

The interdependencies are illustrated by the arcs between them and described by their cause-and-effect relationships.

For example, Food Security (Communities) depends upon a sustainable and accessible Market for Marine-Derived Products (Markets) which, in turn, depends on sufficient Biomass (Ecosystems) that enable extraction without destabilising the broader ocean ecosystem.

The map depicts a narrative of a healthy, self-sustaining future system, one that is currently endangered by human activity. Realising this future requires intervention, in the form of sustainability transitions in our industrial and market systems, accompanied by the smart scaling of markets for restoration, and enabled by behaviour change and citizenship in support of a healthy ocean.

Map Features

Interventions

The Interventions are drawn from global taxonomies. Click the buttons at the top of the screen to showcase interventions by ocean-linked sector.

Initiatives

These interventions are applied by real-world, market and non-market initiatives, including investable companies and projects.

Click the initiative circles to reveal links to their website and a brief description.

Initiatives are drawn from the portfolios of our partner investors. Click the Investor Flags button at the bottom of the screen to see where funds/funders are engaged.

Tour

Want to explore the full interactive map? Please view this page on a desktop browser.

Join Us

The Ocean Returns is a shared effort of Katapult Ocean and Builders Vision

Our mission is to expand and share knowledge about the Ocean Economy and encourage a regenerative approach to investing.