70% of our planet. 2.5x growth.

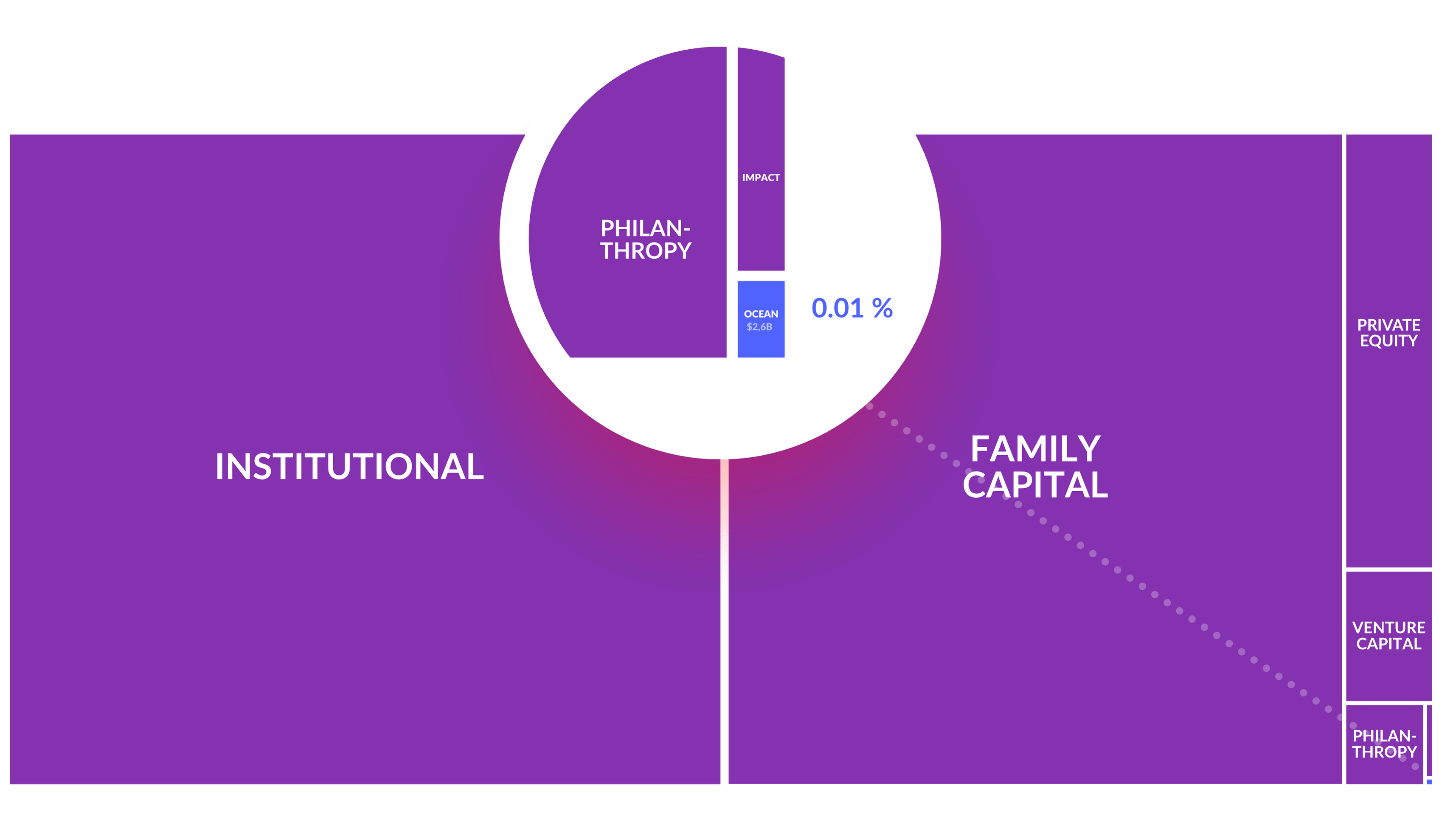

Less than 0.01% of investments.

Ocean degradation is destroying market value and the growing gap between value at risk and return represents a significant investment opportunity. Investment returns will accrue to those who think in generations and understand the capital contribution of our natural systems.

70% of our planet. 2.5x growth.

Less than 0.01% of investments.

Ocean degradation is destroying market value and the growing gap between value at risk and return represents a significant investment opportunity.

Investment returns will accrue to those who think in generations and understand the capital contribution of our natural systems.

PART ONE

PART ONE

A Changing Ocean

Puts Assets on the Line

Global value chains depend on a healthy ocean. This includes industries that feed us, such as fisheries and aquaculture; house us through coastal real estate; supply us via global shipping and trade; power us through offshore energy; and inspire us with coastal tourism.

Additionally, any sector reliant on a stable climate and water cycle also depends heavily on ocean health.

As marine ecosystems deteriorate, revenue, valuations, and insurability inevitably decline.

The Science Behind the Risk

The ocean covers two‑thirds of Earth and absorbs 90 % of the heat trapped by greenhouse gases. Its upper 700 m have already warmed about 1.5 °C since 1900.

So much CO₂ is dissolving into seawater that pH has fallen 26 % since the 1940s, affecting marine creatures’ ability to build calcareous shells. On today’s trajectory it will hit 7.95 by 2045, an irreversible tipping point for most marine life.

As a result, 28 % of assessed marine species face extinction. Populations of marine mammals, birds, fish and reptiles have plunged 56% since 1970 and 90 % of large predatory fish are gone. We are witnessing the real-time unbalancing of our oceanic life support-system.

Ocean warming is disrupting a critical natural process that removes CO2 from the atmosphere. As surface waters heat up, they mix less with nutrient-rich deeper waters. This starves phytoplankton and other organisms that normally absorb CO2 and carry it to the ocean floor when they die.

With fewer of these organisms, the ocean absorbs less CO2, leaving more greenhouse gases in the atmosphere. This creates more warming, which further reduces the ocean's ability to absorb CO2 - a dangerous feedback loop.

If this continues, we could lose one of Earth's most powerful tools for fighting climate change and witness the collapse of ocean ecosystems.

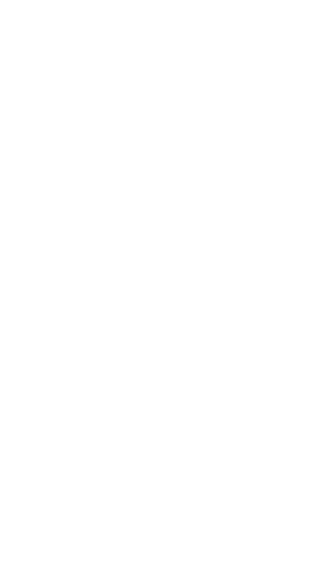

Crossing Planetary Guardrails

In 2023 scientists confirmed that six of nine planetary boundaries, including climate and biosphere integrity, have been breached.

Source: Azote for Stockholm Resilience Centre, based on analysis in Richardson et al 2023

The ocean has shielded us so far, but its buffering capacity is shrinking fast, accelerating existing material breaches in ecological capacity.

Value at Risk

Paolo Pagnottoni et al. (2022) examined the impact of biological, climatic, geological, hydrological and meteorological disasters in 104 countries on 27 global stock market indices and found that the climatic and biological dimensions had the strongest impact on international financial markets.

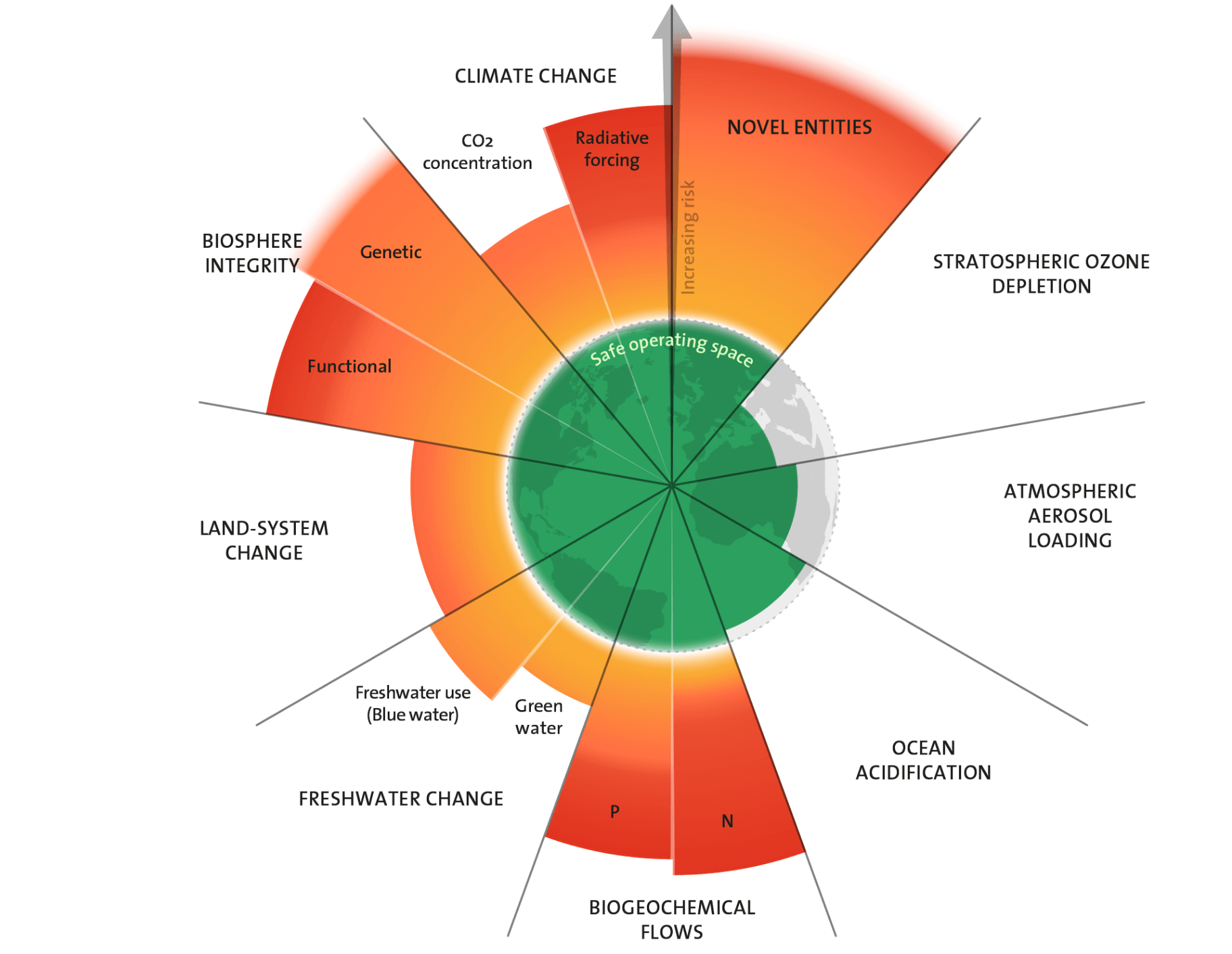

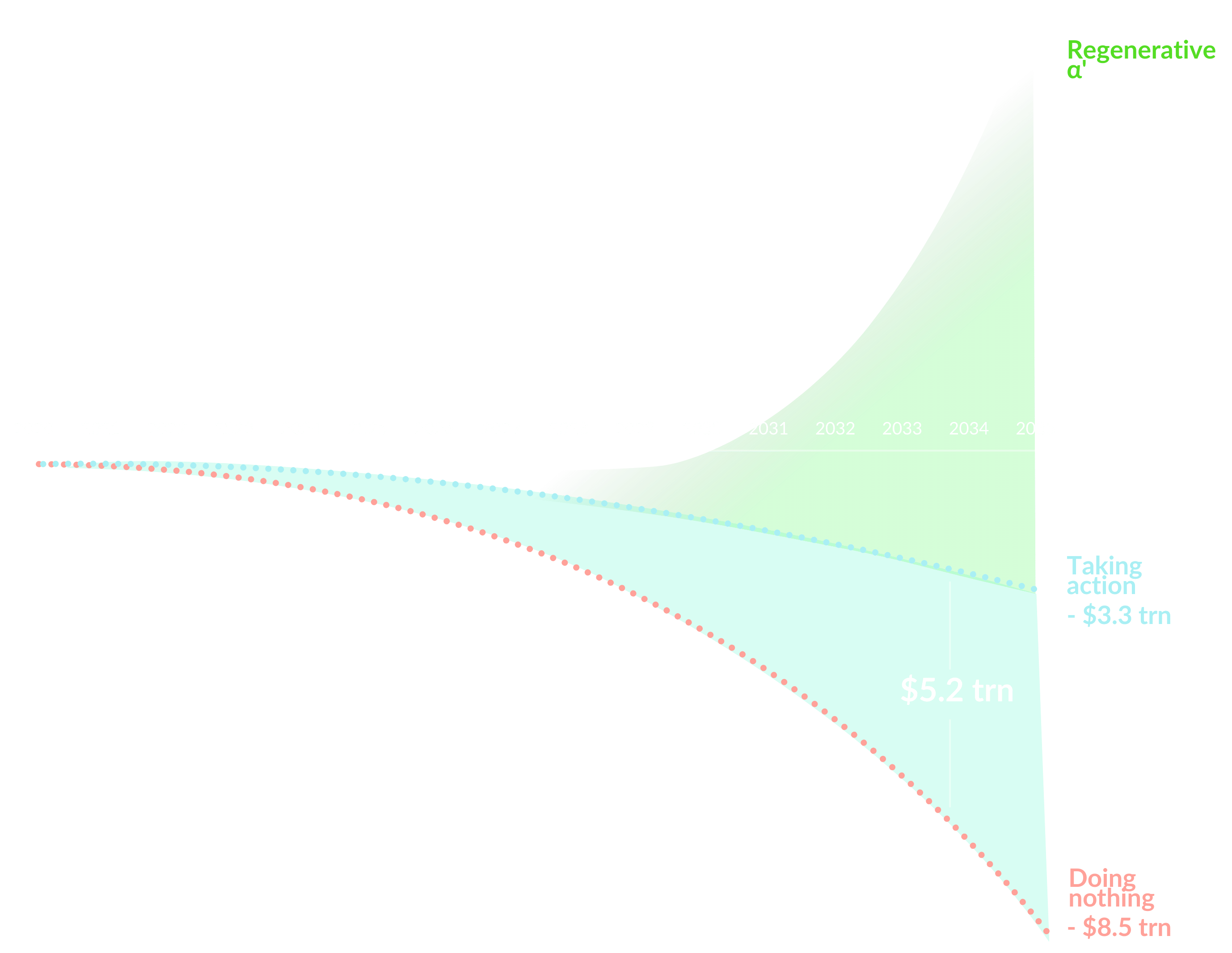

On a business‑as‑usual path, over US $8.4trillion of assets and income are exposed over the next 12 years.

Source: Kennedy, Erin & Xu, Dora et al. (2021). Navigating Ocean Risk Value at Risk in the Global Blue Economy. 10.13140/RG.2.2.34945.38244.

70 % of the planet. 2.5x growth.

Less than 0.01 % of our investments

The Investment Gap

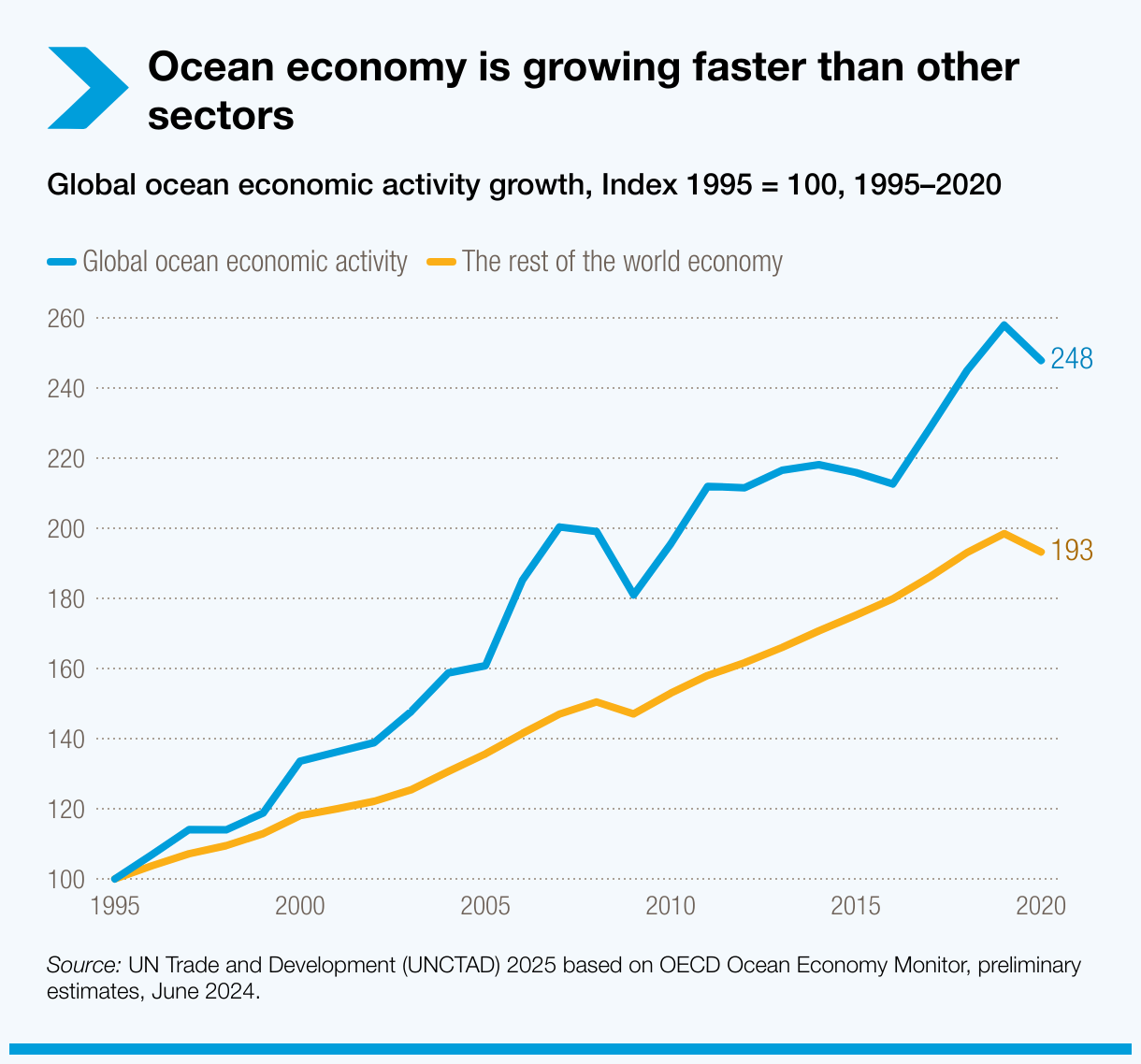

Ocean Industries’ Growing Economic Importance

The ocean economy contributed US $2.6 trn to the global economy in 2020 and is growing at a faster rate. While it is expected to double in size by 2050 (OECD, 2025), how do we ensure that this expected growth is sustainable? Investment remains remarkably small and not representative of the ocean’s integral role in the global economy.

Current Ocean Funding

A sliver of the pie: 70 % of the planet, 2.5x growth, 0.01 % of our investments.

Despite the ocean economy growth, it’s slice of global capital is vanishingly small:

- Institutional firepower – Pension funds, insurers and sovereign wealth funds oversee ≈ US $100 trn⁵. Publicly disclosed “blue” mandates add up to US $69 bn—less than 0.1 %.

- Impact capital – The impact‑investing market stands at US $1.57 trn; ocean‑related deals attract < US $16 bn—well under 1 cent on the dollar.

The Investment Gap

Ocean Industries’ Growing Economic Importance

The ocean economy contributed US $2.6 trn to the global economy in 2020 and is growing at a faster rate. While it is expected to double in size by 2050 (OECD, 2025), how do we ensure that this expected growth is sustainable? Investment remains remarkably small and not representative of the ocean’s integral role in the global economy.

Current Ocean Funding

A sliver of the pie: 70 % of the planet, 2.5x growth, 0.01 % of our investments.

Despite the ocean economy growth, it’s slice of global capital is vanishingly small:

- Institutional firepower – Pension funds, insurers and sovereign wealth funds oversee ≈ US $100 trn⁵. Publicly disclosed “blue” mandates add up to US $69 bn—less than 0.1 %.

- Impact capital – The impact‑investing market stands at US $1.57 trn; ocean‑related deals attract < US $16 bn—well under 1 cent on the dollar.

The Ocean receives less than 0.01% of total investments.

Sources: Family Capital --The World Wealth Report 2024; The World Bank; Preqin's Global Report 2023; McKinsey's Global Private Markets Review 2024; World Economic Forum;

Ocean Philanthropy --In Our Shared Seas report "Funding Trends 2023: Tracking the State of Global Ocean Funding"

PART TWO

PART TWO

Shifting Paradigm

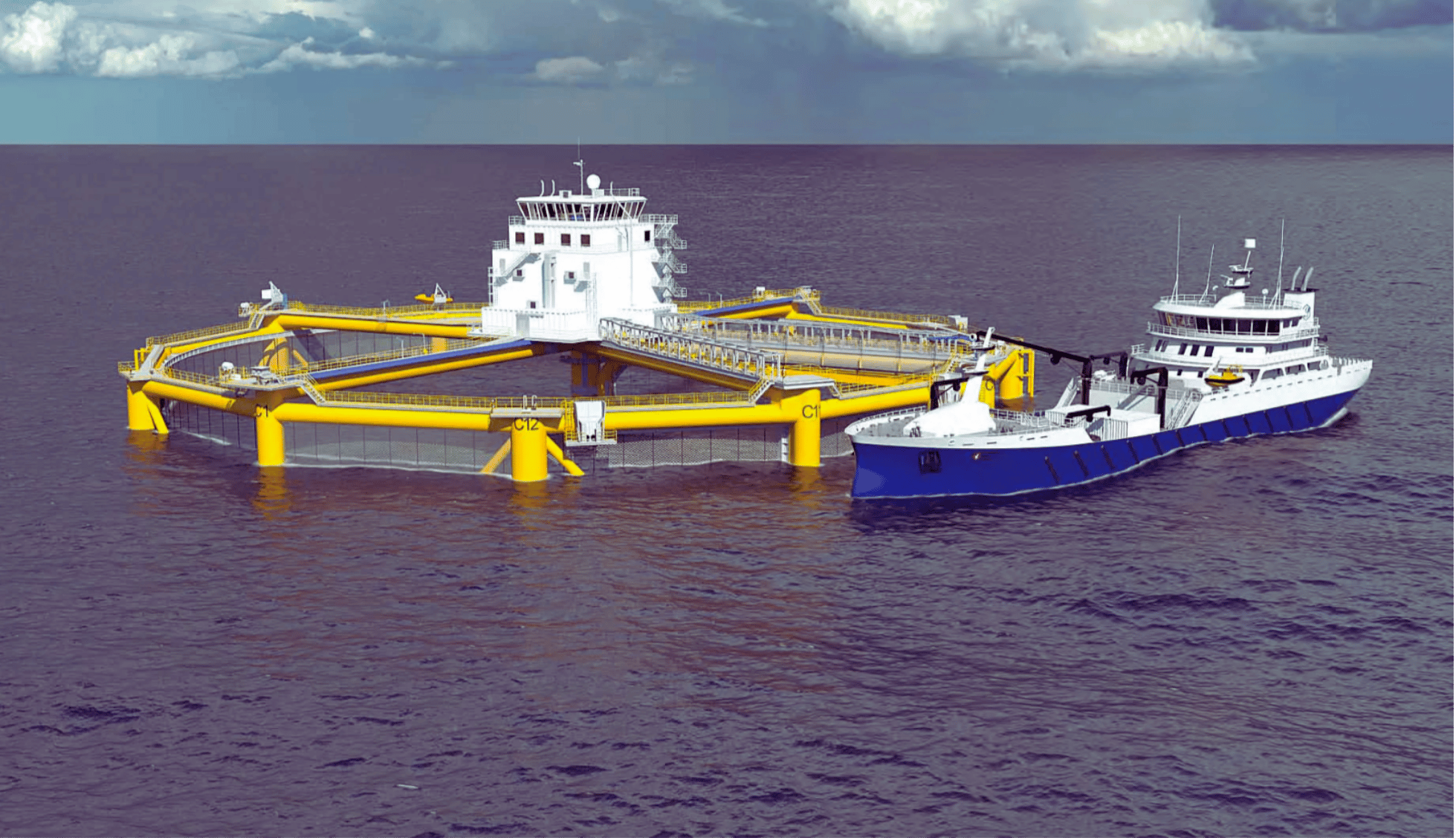

Ocean ventures have historically been seen as distant opportunities, with investors mistakenly assuming lengthy timelines of 10 to 20 years or more for development, monitoring, and deployment.

This misconception has kept investors away from sectors ranging from green-fuel infrastructure to mangrove restoration, limiting their interest primarily to yield-focused investments in established industries such as shipping and aquaculture.

Even risk-tolerant capital hesitated, deterred by assumptions that marine environments posed insurmountable challenges for technology deployment. But today, those perceptions are changing rapidly and and the shift to a regenerative ocean economy is accelerating.

In April 2025, the International Maritime Organization (IMO) approved the world’s first global, sector-wide carbon pricing & emissions reduction regulation framework. This breakthrough accelerates investment into shipping decarbonization and makes marine tech essential.

Meanwhile, sectors like aquaculture are heading further offshore, creating demand for independent, reliable ocean energy solutions, such as wave power and floating solar. And as offshore activities multiply, so does the market for ocean data, marine analytics, and coastal monitoring tools.

Climate-driven flooding events are rising sharply, driving urgent need for technologies to predict and manage coastal flood risks. Simultaneously, water and food scarcity are pushing communities worldwide to ocean-based solutions like seaweed farming for sustainable protein production and freshwater access.

In short, the era of heavily discounting the long-term benefits and positive externalities of ocean technologies is behind us. Clear market demand and tangible financial returns have arrived. Making the investment case undeniable.

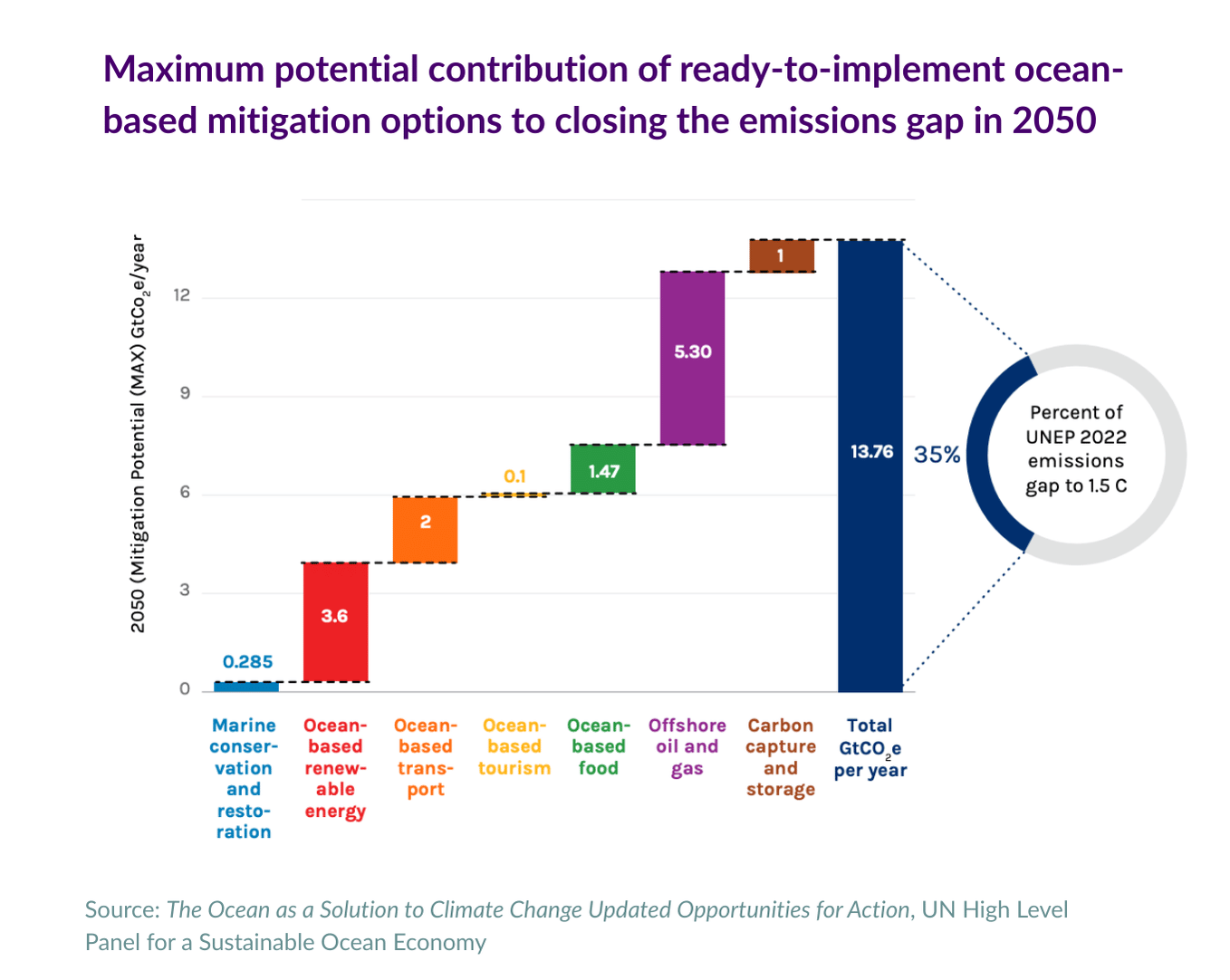

In fact, full implementation of ocean-based climate solutions that are ready for action now could reduce the emissions gap by up to 35 percent on a 1.5°C pathway in 2050.

Five-Trillion-Dollar Upside

US $5.2 trn by 2040, offsetting 60 % of projected losses. The figure includes avoided damage plus new revenue streams from clean energy, biotechnology and ecosystem services.

Source: Kennedy, Erin & Xu, Dora et al. (2021). Navigating Ocean Risk Value at Risk in the Global Blue Economy. 10.13140/RG.2.2.34945.38244.

1.

Resolve Seed‑Stage Mismatch

Often a mismatch between fund size and market stage, where very large funds cannot invest in more nascent, and often smaller, markets and rounds.

The Opportunity

For emerging fund managers and smaller funds to capitalize on great and well-priced investment opportunities.

For new fund structures to bridge the gap between stages. LP collaboration with managers can create products fitting for industrial transformation to increase capital momentum and allocation efficiency.

2.

Rectify Allocation Inertia

Asset‑allocation teams can simply view blue economy investments as too niche to justify research and dedicated allocation.

The Opportunity

For smaller the more agile allocators and family offices to deploy capital ahead of larger institutions into a high growth, high impact domain.

3.

Remedy Risk Myopia

The value at risk to industries including fisheries, tourism and property, sits off of corporate balance sheets, thus models understate upside (and indeed downside risk).

The Opportunity

Business models and financial instruments which facilitate cashflow to natural assets and their stewards will enable pricing and insurability, and better pricing of the asset and the upside / downside risks of its thriving or destruction.

4.

Reduce Institutional Drag

Pension funds face liability‑matching rules, career risk and incentive structures that curb longer‑dated moves.

The Opportunity

Trend from defined benefit to defined contribution pension schemes can enable greater flexibility to optimize for return over holding period. Greater engagement of pension fund beneficiaries with managers and trustees, relating to allocation and corporate governance, can enable a greater pull towards triple bottom line investments.

5.

Reverse Insurance Paradox

Underwriters cannot insure assets beyond their financial value and an owners ability to afford the risk premium, which becomes uninsurable in the face of systemic risks.

The Opportunity

For financial yield from natural capital - tourism, coastal defence, fishery yield, to enable natural ecosystem insurance. This can facilitate a risk pricing interaction between insured assets which degrade ecosystems and the insured ecosystems themselves- increasing premium and cost of capital toward the assets impacting ecosystems.

6. Remove

Short-Term Lenses

Benchmarks and bonus cycles reset every 12 months, pushing managers toward quick exits.

The Opportunity

For institutions to revisit bonus models, incentive structures and culture to ensure that career risk and short term returns are not detracting from long term outperformance.

1.

Resolve Seed‑Stage Mismatch

Often a mismatch between fund size and market stage, where very large funds cannot invest in more nascent, and often smaller, markets and rounds.

The Opportunity

For emerging fund managers and smaller funds to capitalize on great and well-priced investment opportunities.

For new fund structures to bridge the gap between stages. LP collaboration with managers can create products fitting for industrial transformation to increase capital momentum and allocation efficiency.

2.

Rectify Allocation Inertia

Asset‑allocation teams can simply view blue economy investments as too niche to justify research and dedicated allocation.

The Opportunity

For smaller the more agile allocators and family offices to deploy capital ahead of larger institutions into a high growth, high impact domain.

3.

Remedy Risk Myopia

The value at risk to industries including fisheries, tourism and property, sits off of corporate balance sheets, thus models understate upside (and indeed downside risk).

The Opportunity

Business models and financial instruments which facilitate cashflow to natural assets and their stewards will enable pricing and insurability, and better pricing of the asset and the upside / downside risks of its thriving or destruction.

4.

Reduce Institutional Drag

Pension funds face liability‑matching rules, career risk and incentive structures that curb longer‑dated moves.

The Opportunity

Trend from defined benefit to defined contribution pension schemes can enable greater flexibility to optimize for return over holding period. Greater engagement of pension fund beneficiaries with managers and trustees, relating to allocation and corporate governance, can enable a greater pull towards triple bottom line investments.

5.

Reverse Insurance Paradox

Underwriters cannot insure assets beyond their financial value and an owners ability to afford the risk premium, which becomes uninsurable in the face of systemic risks.

The Opportunity

For financial yield from natural capital - tourism, coastal defence, fishery yield, to enable natural ecosystem insurance. This can facilitate a risk pricing interaction between insured assets which degrade ecosystems and the insured ecosystems themselves- increasing premium and cost of capital toward the assets impacting ecosystems.

6.

Remove

Short-Term Lenses

Benchmarks and bonus cycles reset every 12 months, pushing managers toward quick exits.

The Opportunity

For institutions to revisit bonus models, incentive structures and culture to ensure that career risk and short term returns are not detracting from long term outperformance.

The Scale is Massive

4 Key Action areas

Under-served growth markets with capacity for investment and great benefit-cost ratios

Maritime

Decarbonization

Switching the global fleet to green fuels requires ≈ US $46 bn annually. Venture capital in 2023: was less than US $1 bn

The benefit-cost ratio estimated at 4:1

Offshore

Renewables

Floating wind, tidal and wave energy need ≈ US $32 bn a year. Venture capital in 2023: US $0.3 bn

With a benefit-cost ratio estimated at 12:1

Sustainably-Sourced Ocean Proteins

Reforming wild-capture and increasing sustainable production of ocean-based aquaculture

Every $1 invested in increasing production of sustainably sourced ocean-based protein is estimated to yield $10 in benefits

Marine Ecosystem Restoration

Mangroves, reefs and seagrass add US $1.1 trn in coastal protection and carbon storage by 2050 but attract < 0.3 % of required early‑stage capital

Every $1 invested is estimated to yield $3 in benefits

4 Key Action areas

Under-served growth markets with capacity for investment and great benefit-cost ratios

Maritime

Decarbonization

Switching the global fleet to green fuels requires ≈ US $46 bn annually. Venture capital in 2023: was less than US $1 bn

The benefit-cost ratio estimated at 4:1

Offshore

Renewables

Floating wind, tidal and wave energy need ≈ US $32 bn a year. Venture capital in 2023: US $0.3 bn

With a benefit-cost ratio estimated at 12:1

Sustainably-Sourced Ocean Proteins

Reforming wild-capture and increasing sustainable production of ocean-based aquaculture

Every $1 invested in increasing production of sustainably sourced ocean-based protein is estimated to yield $10 in benefits

Marine Ecosystem Restoration

Mangroves, reefs and seagrass add US $1.1 trn in coastal protection and carbon storage by 2050 but attract < 0.3 % of required early‑stage capital

Every $1 invested is estimated to yield $3 in benefits

The Ocean Returns is a shared effort of Katapult Ocean and Builders Vision.

Our mission is to expand and share knowledge about the Ocean Economy and encourage a regenerative approach to investing.