The right data provides clarity, confidence, and informed decisions, especially when navigating emerging spaces like the Blue Economy. Being data-driven means closely tracking trends, mapping opportunities, and deepening our understanding to change the system.

Let's deep dive and learn about the Venture Capital Trends, the Startups and Sectors, and who is Allocating capital and Investing in them.

We’re proud to partner with Dealroom to shed light on this evolving sector, equipping impact investors with robust insights and tools to make smarter choices. Special thanks to Eglantine Dupuy from Dealroom for her outstanding analysis and expertise, helping illuminate the path forward in blue economy investing.

VC Trends

Blue Economy VC Trends

The Macro Picture • Allocations by Stage • Early Stage • Breakout Stage • Late Stage • Industry Comparison • Top Countries • Oceans & Sea Basins

The Macro Picture

In the last 10 years, there has been a major increase in awareness around oceans. The Blue Economy ecosystem has seen significant growth, projected to reach $3B in 2024. Blue economy VC funding has grown over 7x in the last 8 years.

In the last few years, most funding has gone into shipping and ports, such as freight forwarding and supply chain management solutions, especially in 2021-2022 after the pandemic supply chain disruptions.

Bluetech and ocean observation (mostly autonomous defense vessels), Shipbuilding & refit, and Shipping & ports and have instead dominated funding in 2025.

When looking beyond shipping and ports, the rest of Blue Tech attracted $1.9B so far in 2024, a 30% decline from the previous year's (outlier) record high.

VC Allocation by Stage

We divide venture capital into three stages: Startup ($0–15M), Breakout ($15–100M), and Scaleup ($100M+). This segmentation is more consistent and enduring than self-reported round labels, which vary widely across business cycles.

Investments in the blue economy grew significantly after 2020, but in 2024 they contracted for the first time—ignoring the 2022 boom—by USD 0.5 billion (-18%), alongside a 25% drop in deal volume.

In 2025, the sector rebounded strongly, with Q1 funding reaching 50% of FY24’s total. However, this growth is driven mostly by mega-rounds, as the number of deals stands at just 45% of 2024’s count so far.

Early Stage Investment

In 2024, early-stage (Pre, Seed & A) showed most resilience with $720M worth of deals the number of rounds, however, (260) has been in consistent decline since its highest year in 2021 (418).

Volume of investment

Number of rounds

Late Stage Investment

Late stage has had sporadic activity, with only two deals in 2024. 2025 has already surpassed 2024’s total volume largely due to Saronic Technologies’ $600M mega round.

Comparison With Other Industries

Blue Economy has been one of the fastest growing venture capital sectors, with a nearly 300% increase in the last six years, followed by Energy and Semiconductors.

However, It is still a much smaller overall market than many others, Climate tech attracted 15x more funding in 2024.

You can sort the table below by clicking on the columns.

The Blue Economy ecosystem is still in an earlier stage of development with respect to more mature VC markets like fintech or even the broader climate tech space. Nonetheless, it is making up a growing share of global climate tech funding, reaching a record high 5% in 2023.

A higher % of blue economy startups have been founded in the last five years and the number of early-stage rounds far out numbers exits still in contrast with mature segments like fintech.

Top Countries and Regions

The Nordics are the countries with the most share of funding going into the Blue Economy. Portugal and Mexico also show a strong focus on the blue economy.

The US leads Europe for bluetech VC funding in 2024, with all regions showing a drop from the previous year. Bluetech funding is still heavily concentrated with these two regions accounting for 80% of all investments in 2024.

The US is the leading country for 2024 blue economy investments, followed by UK, Sweden and China. Indonesia's strong growth is mostly led by aquaculture companies.

Oceans and Sea Basins

When analyzing the Blue Economy, we need to look beyond countries, regions, and continents to also Oceans and Sea Basins.

Often, industry associations, partnerships and intercountry agreements are, in fact, shaped around these areas of operation.

Considerable overlap exists among the different areas, with for instance US and Canada active in all Atlantic, Artic and Pacific regions, and Nordic countries such as Sweden and Norway active in both North Sea and Artic Sea.

Since 2018, the Artic, Pacific and Atlantic, have attracted the most funding, mostly driven by the US.

Looking beyond the US, The North Sea saw the strongest investments.

Startups & Sectors

Blue Sectors

Blue Renewable Energy • Bluetech & Ocean Observation • Blue Biotechnology • Ocean Environmental Protection

We break down the Blue Economy into 10 segments and over 30 subsegments, here we will focus on 3 segments, for the full breakdown see the Blue Economy Guide.

Explore the interactive chart by navigating the changes through the years.

You can also click on a segment to zoom in and see the subsegments inside better.

Blue Renewable Energy

VC funding in Blue renewable energy startups has grown from less than $100M per year in 2018-2020 to approximately $300M in 2022 and 2023. However, 2024 is projected to decline at least 3 fold compared to these record highs. $1B has been invested since 2016.

Offshore wind attracted nearly 3/4 of all Blue renewable energy funding. This is not surprising since offshore wind is the most mature of the ocean's renewable energy sources. In the US, it is estimated that offshore wind potential exists for over 4,000 GW of capacity —more than three times the country’s installed electricity generation capacity. Companies in the field include Venterra (offshore wind services), Gazelle Wind Power (hybrid floating offshore wind platforms), and Principle Power (wind turbine agnostic floating platform).

Wave and tidal energy is still in the early stages of development despite having the potential to exceed the global power demand of 22,848 TWh/y. There are several methods of producing energy, and they commonly involve placing electricity generators on the ocean's surface, but also submarine installations. Ever since its uptake in 1973, several conversion technologies were introduced in the market, with different characteristics and deployment suitability.

Companies operating within this field include AW-Energy and CorPower Ocean.

Even more nascent is the segment of ocean thermal energy, which exploits thermal energy harvesting systems to create electricity underwater from temperature differences in the ocean. Early innovators include Seatrec and Global OTEC Resources.

Floating solar panels are also gaining interest from investors, with a record $18M of funding in 2023, up from nearly nothing in 2018-2019, but the sector is still in a very early stage.

Examples of companies include Solar Duck and Oceans of Energy. Some of the main advantages of floating solar are space utilization (no land use) and better efficiency, thanks to the cooling effect from water. However, they also suffer from typical offshore installation challenges such as high maintenance and infrastructure costs (foundation, grid connection, etc).

Floating solar accounted for less than 1% of total solar installations in 2022 and accounted for only 0.003% of all solar energy VC funding in 2023.

Overall, Blue renewable energy attracted less than 2% of global renewable energy VC funding in 2024.

Marine energy can be a challenging resource to harness: salt water and sediment could damage ocean-bound machines; devices must be able to withstand strong wave and tidal conditions; and deploying or servicing devices offshore can be costly in terms of time and money.

Hence, higher costs, natural barriers and lower technology readiness play an important role in the development of this market.

Explore 120+ Blue renewable energy startups.

Bluetech and Ocean Observation

VC funding in Bluetech and ocean observation has already reached a high of $728M in 2025, a 53% increase from 2024, the second best year.

Over $2.3B have been invested since 2016.

Drones, surface and subsea robots have attracted 70% of the funding in the sector. Example of companies include Saildrone (operating fleets of autonomous surface drones for defense and ocean mapping), Bedrock Ocean Exploration (autonomous vehicles for seafloor mapping), Skyspects (drones for offshore wind turbines inspection and maintenance), and Tekever (drones for monitoring of ocean activities).

Space tech for maritime monitoring is also attracting considerable funding, such as Unseenlabs, which enables the tracking of maritime vessels at any location using satellite data.

Another interesting segment is underwater communication, such as Wsense.

Explore 135+ Bluetech and ocean observation startups.

Blue Biotechnology

Blue biotechnologies, or marine biotechnologies, are processes that transform marine resources into services and goods in a multitude of fields. These include microorganisms (microalgae, bacteria, and fungi), seaweed & algae, and invertebrates (e.g., starfish, sea cucumbers, and sea urchins).

VC funding in Bluetech biotechnology peaked at over $300M in 2022 and is now projected to drop 45% by 2024's end.

Over $1B have been invested since 2016.

Half of the funding into this segment went into seaweed and algae startups for a variety of applications. Applications range from pharma (Lumen Bioscience uses a patented technology to use the well-known food algae spirulina to deliver therapeutic proteins), food (Brevel develops microalgae-based alternative proteins), feed supplements for cow methane emission reduction (CH4 global) and biomaterials & biofuels (Viridos produces sustainable, low-carbon, algae-based jet and diesel fuel; Sway seaweed-based bioplastic).

Beyond seaweed and algae, some startups are exploiting other marine resources for innovative applications, such as Jellagen, which uses jellyfish to produce Collagen Type 0 for complex tissue engineering and regenerative medical needs, and Hemarina which develops marine oxygen carriers for industrial and therapeutic applications based on the particularities of purified hemoglobin from lugworms, Arenicola marina.

Explore 270+ Blue biotechnology startups.

Ocean Environmental Protection and Regeneration

VC funding in Ocean environmental protection and regeneration has increased strongly in the last three years, with the first companies in the segment starting to raise Series B+ rounds.

Over $400M have been invested since 2016.

The ocean is one of the main repositories of the world's biodiversity, counting over 90% of the habitable space on the planet and contains some 250,000 known species. Such biodiversity is crucial for innumerable life aspects, from social to economic and environmental.

Yet, just 3.4% of the ocean is protected, and only part of this is effectively managed.

As a consequence, nearly 10% of marine species are found to be at risk of extinction, with climate change impacting at least 41% of threatened marine species. Populations of marine vertebrates, specifically, (mammals, birds, fish and reptiles) declined by 56% since 1970.

Over $200M since 2016 has been invested into ocean biodiversity protection and tracking, across biodiversity tracking startups such as Spoor (SaaS data platform that enables continuous monitoring of wildlife for offshore wind farms, pre and post construction), and biodiversity regeneration startups such as Urchinomics (which removes overgrazing sea urchins which helps turn a barren seafloor back into a vibrant kelp forest), and Coral Vita (using proprietary technology to grow resilient corals 50x faster to restore dying reefs.).

Ocean carbon removal (CDR) is also starting to pick up, $82M raised in 2024. This accounted for 10% of overall carbon removal, which has so far mostly focused on land, a still low share but the highest historically.

Oceans are in fact naturally key carbon sinks, absorbing nearly one-quarter of all carbon emissions. This has, however, caused the ocean to become 26% more acidic since the 1940s (its pH has changed from 8.2 to 8.04 in 2020) and might see a drop to 7.95 by 2045, a level at which it is estimated that 80% to 90% of all remaining marine life will be lost, triggering an irreversible tipping point for oceans.

Ocean CDR aims, therefore, to leverage the ocean’s natural chemical and biological processes to capture and remove carbon from the atmosphere while often also reducing the adicity (enhancing the alkalinity) of the ocean.

Ocean CDR spans a wide range of approaches, each with different levels of scientific reliability and efficacy. Overall, seven main approaches are thought to be the most effective and scalable from biotic approaches such as coastal wetland & mangroves restoration and seaweed (especially kelp) cultivation, to engineered approaches like alkalinity enhancements and electrochemical CO2 removal.

Key companies operating within this field on the abiotic side include Captura (using direct ocean capture, DOC, by extracting carbon absorbed by the ocean surface), Ebb Carbon and Heimdal (electrochemical ocean alkalinity enhancement by pumping out seawater and removing carbon), Limenet (using a carbon mineralization method able to transform the carbon dioxide collected from the atmosphere or other sources into an aqueous solution of calcium bicarbonates which helps ocean alkalinity).

On the biotic (nature-based solutions, NBS) side, most attention has been toward kelp and algae, with startups such as CarbonWave (large-scale Sargassum seaweed plantation to capture carbon and replace petrochemicals materials) and Brilliant Planet (which grows, dries and buries algae in the desert to remove carbon permanently).

Explore 95+ Ocean environmental protection and regeneration startups.

Capital Allocators

Top Investors, Accelerators and Ecosystem Actors

Top Investors • Top Accelerators • Top Blue economy Investors & Funds • Public Blue Economy Initiatives

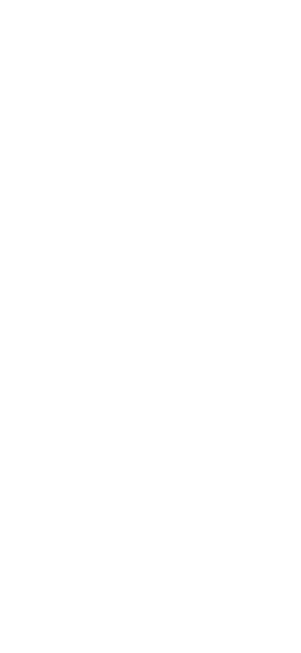

Blue economy specialists and climate tech VCs make up the most active investors in the sector.

Notable is also the strong activity of SOSV, a generalist fund with a strong climate activity focus.

Top Accelerators

Blue economy specialists and climate tech accelerators are the most active early supporters of blue economy startups.

A Rising Tide lifts all boats

The number of funds investing specifically in the blue economy has grown substantially in recent years – by our estimates, growing from <10 before 2020 to approximately 40 today. Additionally, many generalists, both climate-general and broad market general, have begun adding blue economy exposure. Collaboration amongst the incumbents and new entrants has been and remains a key catalyst in growing capital into the space.

A rising tide indeed.

– Katapult Ocean Team.

In 2024 nine funds were raised specifically to support ocean-related startups, totalling $1 billion.

When examining the capital allocation from different investor types, ocean specialists account for just 3% of the venture capital directed toward blue economy startups.

When analyzing by stage, blue economy specialists are most active in the early stages, providing crucial support to help startups launch. However, their presence significantly diminishes in later stages of funding.

Looking at Notable LPs investing into these Blue economy focused funds, names such as the EIF, The Luxembourg Future Fund and Farvatn Venture are most recurring.

Public Blue Economy Initiatives

Despite such challenges, the last years have seen important improvements and initiatives rising both in the public and private realms.

We have summarized below a list of the main institutional and public initiatives created in recent years that are inevitably connected with the unfolding of private ocean-tech innovations.

The ‘BlueInvest’ investment platform was launched by the European Commission in April 2019, with the goal of fostering investment, innovation and sustainable growth in the Blue Economy.

The platform supports innovative SMEs and start-ups active in the Blue Economy sectors, through its online community, investment readiness assistance, matchmaking, investor outreach and engagement, its academy, projects pipeline and a BlueInvest Fund.

The 1000 Ocean Startups coalition was launched in 2021 and unites the global ecosystem of incubators, accelerators, competitions and investors supporting startups for ocean impact.

The Convention on Biological Diversity’s (CBD) Fifteenth Conference of the Parties (COP 15), which took place in Montreal from December 7 to 19, 2022. Here, countries pledged to protect 30% of the ocean, land and coastal areas by 2030 (known as ‘30×30’). This was a first important step to bridging the blue economy and climate regimes, enabling the UN 2030 Agenda for Sustainable Development.

In 2023, member states of the United Nations agreed to a High Seas Treaty that ensures the protection and sustainable use of marine biodiversity in areas beyond national jurisdiction. For the first time in history, rules will be in place to effectively manage and govern oceans. The High Seas Treaty includes an agreement to impose strict ocean protection outside national borders and rules for the sustainable use of its resources.

Ocean Climate Action Plan in the USA. The OCAP is a policy framework introduced in 2023 under the Biden-Harris Administration to safeguard oceans and coastal communities.

The Ocean Climate Action Plan entails deploying offshore energy infrastructure (wind & marine energy); investing in marine conservation through nature-based solutions and carbon removal; and decarbonising marine shipping and transportation.

The Ocean Returns is a shared effort of Katapult Ocean and Builders Vision.

Our mission is to expand and share knowledge about the Ocean Economy and encourage a regenerative approach to investing.